- Bitcoin on Balance

- Posts

- 🟠 Bitcoin Treasury Boom: 159,107 BTC Acquired in Record-Breaking 🇬🇧 Smarter Web & the Rise of the UK Bitcoin Treasuries 📊 Strategy Eyes $4.2B Raise as BTC Gains Hit $14B

🟠 Bitcoin Treasury Boom: 159,107 BTC Acquired in Record-Breaking 🇬🇧 Smarter Web & the Rise of the UK Bitcoin Treasuries 📊 Strategy Eyes $4.2B Raise as BTC Gains Hit $14B

Hello Bitcoiners,

Here’s the week in Bitcoin treasuries.

🟠 Bitcoin Treasury Boom: 159,107 BTC Acquired in Record-Breaking Q2

🇬🇧 Smarter Web & the Rise of the UK Bitcoin Treasuries

📊 Strategy Eyes $4.2B Raise as BTC Gains Hit $14B

🏯 Metaplanet Eyes Profitable Acquisitions Fuelled by Bitcoin

🟠 Bitcoin Treasury Boom: 159,107 BTC Acquired in Record-Breaking Q2

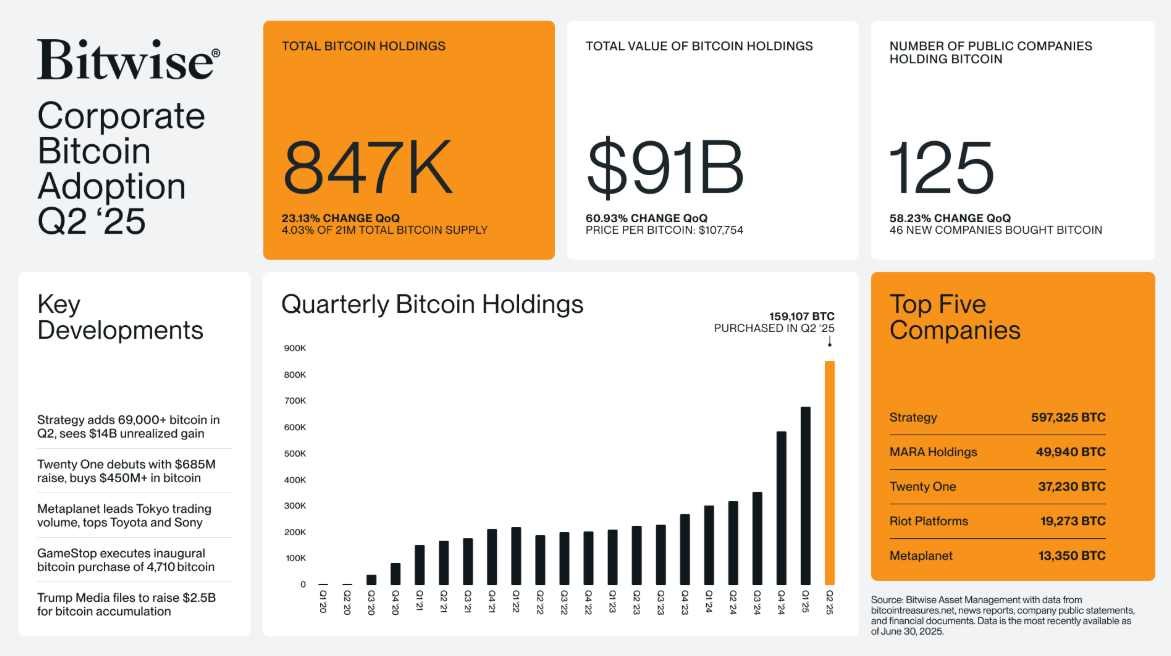

Corporate appetite for Bitcoin is hitting unprecedented highs. In Q2 2025 alone, companies added a record 159,107 BTC to their balance sheets - worth over $17.6 billion at current prices. According to Bitwise Asset Management, this surge brings total corporate holdings to a staggering 847,000 BTC, or 4% of Bitcoin’s fixed 21 million supply.

Let that sink in: Public companies now own one out of every twenty-five bitcoins that will ever exist.

It’s not just an allocation - it’s a transformation.

📈 The Corporate Bitcoin Arms Race Is On

The second quarter saw a 23% jump in corporate Bitcoin holdings. Total value? An eye-popping $91 billion as of June 30, based on a quarter-end BTC price of $107,754 - a 60.93% surge from Q1. Since then, Bitcoin has blasted past $112,000, setting new all-time highs.

🚀 125 publicly traded companies now hold Bitcoin on their balance sheets - a 58% increase from last quarter.

🏦 Who’s Leading the Charge?

📌 Strategy (aka MicroStrategy)

Still the undisputed king of corporate Bitcoin holdings. The Michael Saylor-led juggernaut now commands 597,325 BTC. By funding purchases through convertible notes and at-the-market equity offerings, Saylor has weaponized the corporate balance sheet. His strategy isn’t just about HODLing—it’s redefining modern treasury management.

Result? Strategy’s stock is up 43% YTD, demolishing the S&P 500’s 6.4% gain.

🏗️ MARA Holdings

The Bitcoin mining heavyweight holds 49,940 BTC, with shares climbing over 10% YTD. It remains a bellwether for institutional exposure via the mining sector.

🆕 New Power Players: Twenty One, Metaplanet, GameStop

Twenty One burst onto the scene with a $685M capital raise, immediately deploying $450M into Bitcoin.

Japan’s Metaplanet now owns over 15,000 BTC, dominating Tokyo Stock Exchange trading volume - yes, even beating Toyota and Sony.

GameStop added 4,710 BTC to its treasury - though many expected an even larger purchase - as it continues its memetic transformation from retail underdog to digital asset player.

Even Trump Media filed to raise $2.5B for BTC purchases.

🧠 What’s Driving This Trend?

Why are corporations racing to own Bitcoin?

Inflation Hedge: In an era of fiat debasement and QE, Bitcoin is digital gold.

Balance Sheet Optimization: Cash is a melting ice cube. Bitcoin is antifreeze.

Strategic Edge: Early adopters are seen as innovators. And the market rewards innovation.

Diversification: It’s not about going all-in. It’s about not being all-out.

As regulatory clarity improves and financial infrastructure matures, the barriers for entry continue to fall.

🔐 The Institutional Domino Effect

With 847,000 BTC already locked away on corporate balance sheets, the supply squeeze is real. And with only 21 million BTC ever to exist - and millions lost forever - the math speaks for itself.

More institutions are coming. Less Bitcoin is available. The pressure builds.

🇬🇧 Smarter Web & the Rise of the UK Bitcoin Treasuries

Need proof of where all this is headed? Just look at the UK-based Smarter Web Company.

Once trading at a humble £3.7 million market cap earlier this year, Smarter Web has rocketed to nearly £1 billion - fuelled by its aggressive Bitcoin treasury strategy and AI pivot. The company now holds 773 BTC, acquired at an average price of $107,015 per coin, representing over $82 million in Bitcoin reserves. That’s not just capital allocation - that’s conviction.

But Smarter Web’s rise isn’t just about Bitcoin. It’s about where it’s happening.

The UK market offers fertile ground for Bitcoin treasury plays. Why?

💡 Why the UK Is an Ideal Launchpad for Bitcoin Treasury Companies

1. Retail & Institutional Friction

Despite rising interest, many UK investors - especially those with institutional mandates like pensions and wealth funds - can’t easily hold Bitcoin directly. Whether it’s compliance restrictions, lack of custody infrastructure, or regulatory uncertainty, direct crypto exposure remains out of reach for most.

And we’re not talking about small capital here. The UK pension sector alone manages £3.2 trillion, with £1.24 trillion in defined benefit schemes and over £1.4 trillion in fixed-income instruments. That’s nearly £6 trillion in capital largely side-lined from direct Bitcoin exposure.

Bitcoin treasury companies offer a workaround. By investing in public companies that hold BTC on their balance sheets, investors gain indirect exposure - often through their traditional brokerage, SIPP, or pension accounts—without touching the asset directly.

2. Pension & Wealth Funds Looking for Hedge Assets

UK-based funds are increasingly hunting for alternatives to hedge against inflation, currency debasement, and geopolitical instability. With the pound facing volatility and the real yield on government bonds scraping historic lows, Bitcoin’s fixed supply and asymmetric return profile offer a compelling hedge.

But these funds—again, sitting on £3.2 trillion in pension assets alone - can’t go out and buy Bitcoin directly. Listed Bitcoin treasury companies bridge that gap, delivering crypto exposure within traditional, regulated wrappers.

3. Regulatory Arbitrage

The UK’s Financial Conduct Authority (FCA) has taken a cautious stance on retail crypto products—banning Bitcoin ETNs and curbing crypto marketing to the public. But ironically, that opens the door for publicly listed companies holding Bitcoin to fill the gap.

Bitcoin treasury companies aren’t selling tokens. They’re running businesses with BTC on their balance sheets - giving investors regulated, equity-market access to digital assets without triggering direct crypto restrictions.

4. London Capital Markets Are Hungry

The London Stock Exchange and Aquis Exchange are actively courting digital asset–linked listings. Compared to slower-moving US or EU markets, the UK is shaping up as a friendlier launchpad for early-stage Bitcoin treasury firms.

For companies, that means faster IPOs, engaged institutional capital, and a clearer path to scale via equity raises that tap into the UK’s £6 trillion+ institutional pool.

Smarter Web is just the start. From £3.7 million to nearly £1 billion in months, it’s proven the model: raise capital, hold Bitcoin, build conviction - and let the markets catch up.

As institutional demand grows and regulatory frameworks continue to evolve, the UK could very well emerge as Europe’s capital for Bitcoin-on-balance-sheet plays.

Short ₿its 🌟

📊 Strategy Eyes $4.2B Raise as BTC Gains Hit $14B

Michael Saylor’s Strategy reported $14 billion in Q2 unrealized Bitcoin gains and paused its weekly BTC purchases for the first time since April. The company launched a new $4.2 billion STRD stock sale, part of its broader plan to fuel future Bitcoin accumulation. Strategy’s total ATM raise capacity now exceeds $44.8 billion across all share classes.

🏯 Metaplanet Eyes Profitable Acquisitions Fuelled by Bitcoin

Japanese firm Metaplanet, now holding 15,555 BTC, plans to leverage its Bitcoin treasury to acquire cash-generating businesses, including a possible digital bank. CEO Simon Gerovich calls it a “Bitcoin gold rush,” aiming to secure enough BTC to become untouchable by competitors. The endgame? Use Bitcoin as collateral to build a diversified empire without ever selling a single coin.

🟠 Trump Jr. Bets on Bitcoin-Heavy Startup

Donald Trump Jr. has invested $4M in Thumzup Media, a near-zero revenue startup now holding $2M in Bitcoin—with plans to diversify into six more digital assets.

⚡ KULR Ramps Up Bitcoin Mining

KULR Technology Group (NYSE: KULR) has ramped up its mining ops to 750 PH/s in Paraguay—targeting 1.25 EH/s by late summer—while also adding 90 BTC for ~$10M at an average price of $108,884. KULR hold 1,021 BTC on its balance sheet with a 291.2% YTD BTC yield.

💰 H100 Group Adds 46.93 BTC to Treasury

Sweden’s H100 Group has purchased SEK 49.5M worth of Bitcoin, raising its holdings to 294.5 BTC as part of a capital-preservation strategy backed by a SEK 516M fundraise.

🇫🇷 Sequans Raises $384M to Buy Bitcoin

French chipmaker Sequans Communications (NYSE: SQNS) has closed a $384M private placement to kick off its Bitcoin treasury strategy. Partnering with Swan Bitcoin for execution and governance, Sequans plans to convert excess cash into BTC to boost long-term shareholder value.

🇸🇻 El Salvador’s Bitcoin Stash Tops $702M

With Bitcoin hitting a new all-time high, the country’s holdings have soared to 6,233 BTC, now worth over $702 million.

🇰🇷 K Wave Media Secures $1B for Bitcoin Strategy

K Wave Media has raised up to $1 billion - including a $500M deal with Anson Funds - to fuel one of the most ambitious corporate Bitcoin accumulation strategies to date, already acquiring 88 BTC. The company aims to scale toward 10,000 BTC, integrating Bitcoin into both its treasury and South Korean entertainment empire.

👗 Japan’s ANAP Adds 16 More BTC

Japanese fashion brand ANAP has acquired an additional 15.82 BTC, bringing its total holdings to 200 BTC as it works toward a long-term goal of accumulating 1,000+ BTC by August.

💼 DDC Enterprise Adds 230 BTC, Targets 5,000

DDC Enterprise has boosted its treasury to 368 BTC with a fresh 230 BTC acquisition, delivering a 48.3% return since its last buy and pushing toward a 5,000 BTC goal. Backed by a $100M strategic partnership with Animoca Brands, DDC is cementing itself as a serious player in the corporate Bitcoin race.

Tweet of The Week

A year ago, the German Government sold 50,000 Bitcoin at $55,000

Bitcoin is up 100% since then.

They missed out on a total profit of $2.8 billion and counting...

HFSP, Germany!

— Lark Davis (@TheCryptoLark)

12:30 PM • Jul 9, 2025

Podcast of The Week

🎙️ Bitcoin Treasuries Digital Conference Goes Live

Join host Tim Kotzman and a powerhouse lineup of CFOs, CEOs, and treasury leaders as they reveal how smart corporations are turning Bitcoin into a strategic asset

If you have questions about how Bitcoin could help you or your business, please don’t hesitate to reach out for a free 30-minute consultation 🕒. We're here to help you navigate the future of Bitcoin 💡

Thanks for reading! We hope you’ve enjoyed this week’s edition and look forward to seeing you next week! 👋

Daniel

for Bitcoin on Balance

32 York Street, Sydney NSW 2000, Australia