- Bitcoin on Balance

- Posts

- Metaplanet Unveils “555 Million Plan” to Join the 1% Club 🟧 💥 Strategy Launches $980M Preferred Stock Raise to Buy More Bitcoin 🇦🇺 First on the ASX: Locate Technologies Puts Bitcoin on the Balance Sheet

Metaplanet Unveils “555 Million Plan” to Join the 1% Club 🟧 💥 Strategy Launches $980M Preferred Stock Raise to Buy More Bitcoin 🇦🇺 First on the ASX: Locate Technologies Puts Bitcoin on the Balance Sheet

G’day Bitcoiner,

Here’s the week in Bitcoin treasuries.

🧧 Metaplanet Unveils “555 Million Plan” to Join the 1% Club 🟧

💥 Strategy Launches $980M Preferred Stock Raise to Buy More Bitcoin

🚨 Fidelity Explains What’s Driving The Shift To Bitcoin Treasuries

🇦🇺 First on the ASX: Locate Technologies Puts Bitcoin on the Balance Sheet

🧧 Metaplanet Unveils “555 Million Plan” to Join the 1% Club 🟧

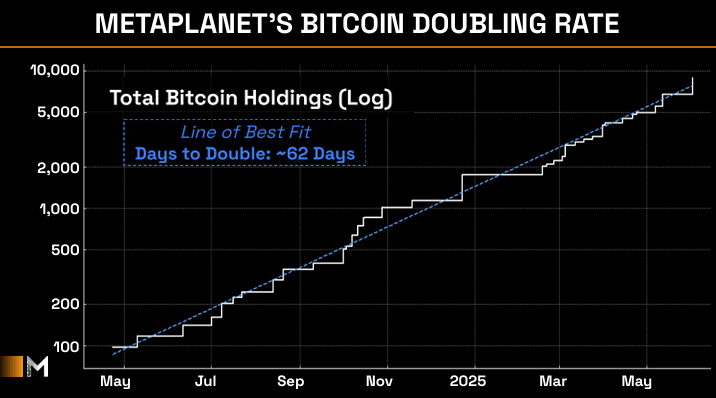

Japan’s Bitcoin-first public company Metaplanet is going all in.

On June 6, the Tokyo-listed firm launched its most ambitious Bitcoin treasury play yet — the “555 Million Plan,” targeting 210,000 BTC holdings by end of 2027 — nearly 1% of all Bitcoin that will ever exist.

💥 That’s right — Metaplanet wants to join the “1% Club.”

And they’re putting their stock where their conviction is.

To fund the buys, Metaplanet is issuing 555 million new shares via stock acquisition rights through a third-party allotment to EVO FUND. The expected capital raise? A staggering ¥770.3 billion (approx. $5.3B USD) — making it one of the largest capital raises in Japanese corporate history.

🛑 “Safe Assets” Aren’t Safe Anymore

Metaplanet’s Bitcoin blitz is a direct response to growing instability in the global financial system.

“The global economy is undergoing a structural transformation — from a traditional supply structure centered on capital and labor to a new economic foundation driven by information technology.”

— Simon Gerovich, CEO

Throw in geopolitical tensions, trade disruptions, and a mountain of sovereign debt, and the writing's on the wall:

🧱 Fiat is crumbling.

📉 Bonds are breaking.

🌍 The postwar monetary regime is running on fumes.

“In this environment, capital has begun flowing out of assets previously considered safe, such as long-term government bonds. Gold has been revalued to record-high levels against major currencies,” Gerovich said, adding:

“Against this backdrop, the strategic importance of Bitcoin — an asset characterized by high scarcity, ease of custody and transfer, and the absence of credit intermediaries — is rapidly gaining recognition.”

📈 555 Million Is the New 21 Million

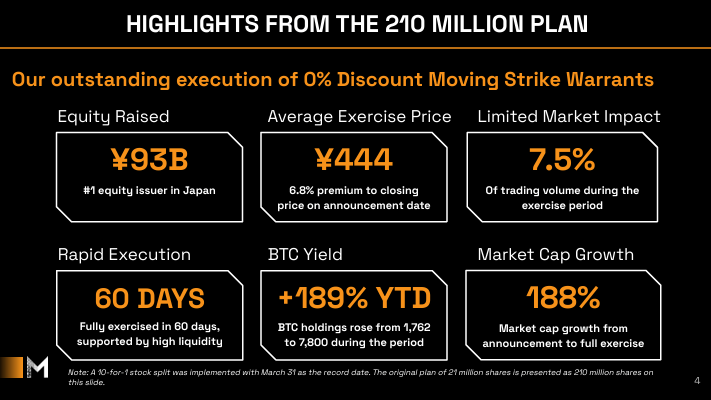

Metaplanet isn’t starting from scratch. Earlier this year, they raised over ¥93B and acquired 8,888 BTC under their “21 Million Plan.”

The initial 2025 goal was 10,000 BTC — and they’re now on track to smash that.

Now? They're 10x’ing the ambition with the “555 Million Plan”:

🧱 555 million new shares on top of 210 million already issued

💸 ¥770.3B target raise (~$5.3B)

🎯 100,000 BTC by end-2026

🚀 Over 210,000 BTC by end-2027

🎟️ Entering the “1% Club” — holding 1% of total BTC supply

🚨 And just like they crushed the 10K BTC target, Metaplanet looks set to blow past this new one too.

⚙️ Deal Mechanics

🔗 EVO FUND (Cayman Islands) is the exclusive allottee

📊 Share issuance structured with no discounts — and even premiums (a Japan-first!)

🔐 Built-in exercise suspension clauses to manage dilution

💹 Flexible pricing adjusts every 3 trading days

Metaplanet’s move sends a clear message: Bitcoin is no longer optional for corporations. It’s the escape hatch from a fiat system under strain.

🧠 Time to rethink your balance sheet.

🏦 Bitcoin is the new base layer.

📊 Will your company lead, or lag?

💥 Strategy Launches $980M Preferred Stock Raise to Buy More Bitcoin

Strategy™ (Nasdaq: MSTR/STRK/STRF) has priced a bold new offering - and it’s all about Bitcoin.

On June 6, Strategy announced the pricing of 11.76 million shares of its new 10% Series A Perpetual Stride Preferred Stock (STRD) at $85/share. The move is set to raise ~$980 million in net proceeds, with one clear use of funds:

"General corporate purposes - including the acquisition of bitcoin."

The deal is expected to close on June 10, with top-tier bookrunners including Barclays, Morgan Stanley, Moelis & Co., and TD Securities.

🧱 Why It Matters

This isn’t a tech stock story. It’s a monetary revolution - one where companies are capitalizing themselves in fiat to accumulate hard money.

With Bitcoin as its treasury backbone, Strategy is reinventing corporate finance, one innovative issuance at a time.

🚀 Raise fiat

🪙 Buy bitcoin

♻️ Repeat

💸 STRD Stock Details: Built to Attract Capital

Dividend Yield: 10% non-cumulative, paid only if declared — giving Strategy full flexibility

Preferred Liquidation Value: $100/share, but price adjusts daily based on market dynamics

Redemption Option: Strategy can buy it back if <25% remains outstanding or if tax laws change

Fundamental Change Clause: Shareholders can force a buyback if key change events occur

And most importantly:

💵 No dividend obligation unless the board decides - meaning Bitcoin stacking stays in focus.

This isn’t just a preferred stock deal. It’s another layer in what may be the most innovative Bitcoin-native capital stack ever assembled.

🏗️ Inside Strategy’s Bitcoin Capital Stack

Strategy isn’t just a HODLer - it’s a capital markets architect, reverse-engineering corporate finance around a Bitcoin-first balance sheet.

“Saylor is coming for the entire fixed income market.”

— Dylan LeClair, Director of Bitcoin Strategy, Metaplanet

Here’s how the stack works - a multi-layered structure of debt, preferred stock, and equity designed to raise capital without compromising control, dilution, or treasury assets:

Layer | Name | Yield | Convertibility | Risk Profile |

|---|---|---|---|---|

🏦 1 | Convertible Notes | Low | ✅ Yes | Institutional debt-like |

🧱 2 | STRF (Strife) | 10% | ❌ No | Senior, investment-grade |

⚡ 3 | STRK (Strike) | 8% | ✅ Yes (at $1,000/share) | Hybrid: yield + BTC upside |

🔥 4 | STRD (Stride) | 10% | ❌ No | High-yield, high-risk |

💎 5 | Common Equity (MSTR) | None | n/a | Pure BTC beta |

🧠 STRD: Yield Without Dilution

The new STRD stock is the most junior preferred share in Strategy’s capital stack:

📈 High-yield (10%) with no voting rights or conversion features

🔒 No compounding obligations — full dividend flexibility

🧲 Attracts yield-seeking investors without diluting equity holders

🛡️ Sits beneath more senior preferreds like STRF and STRK, protecting their quality

Translation:

Strategy just raised nearly $1B without issuing common stock, without selling Bitcoin, and without giving up control.

🧠 Bitcoin on Balance Takeaway

This isn’t a company chasing yield — it’s a capital markets machine converting fiat into Satoshi reserves.

"We don’t want dollars. We want Bitcoin. And we’re happy to sell 10% fiat coupons to get it."

— The implied thesis behind STRD

Strategy’s playbook is clear: monetize Wall Street appetite for yield to accumulate the hardest money on earth.

🟠 If you’re not putting Bitcoin on your balance sheet, someone else is — with your capital.

Short ₿its 🌟

🇬🇧 THE SMARTER WEB COMPANY STACKS 39.52 BTC AFTER £13.4M PREMIUM RAISE

🔥 Backed by a £13.4M (~$17.2M) raise at a 65% premium, they’re scaling their Bitcoin treasury strategy with conviction.

🚨 Fidelity Says Treasurers Are Buying Bitcoin — Here’s Why

Fidelity is sounding the alarm: inflation’s up, fiat’s down, and smart treasurers are turning to Bitcoin. With new accounting rules, rising macro risk, and BTC’s 21M cap, Fidelity says Bitcoin is no longer fringe - it’s financial armor.

🏥 Semler Scientific Doubles Down on Bitcoin

Semler just added another $20M in BTC, bringing its total stash to 4,449 Bitcoin worth ~$473M - up 26.7% since it began buying last year. Despite the bold treasury pivot, shares are down 37% YTD, showing Wall Street hasn’t caught on (yet). MNav currently sits below 1!

🇦🇺 First on the ASX: Locate Technologies Puts Bitcoin on the Balance Sheet

Locate Technologies just made history, becoming the first publicly listed company in Australia to adopt Bitcoin as a treasury asset. After raising $1.45M, the last-mile delivery startup will allocate surplus cash into BTC to bolster its balance sheet and fuel future growth. CEO Steve Orenstein says Bitcoin’s global adoption makes it a strategic move for long-term value creation.

🇳🇴 Norway’s K33 Begins Bitcoin Treasury Strategy with 10 BTC Buy

K33 AB, a Nasdaq-listed digital asset firm, just bought 10 BTC for ~SEK 10M ($1M) — its first move in a bold new Bitcoin treasury strategy. Backed by a fresh SEK 60M raise, K33 plans to stack 1,000 BTC+ over time. CEO Torbjørn Bull Jenssen says Bitcoin will be “the best-performing asset in the coming years.”

🚀 BitMine Immersion Hits NYSE American with $18M Raise

BitMine (BMNR) just completed an $18M public offering and uplisted to NYSE American, with plans to use the cash to stack Bitcoin. The mining-focused firm is betting big on BTC accumulation through both hashpower and capital markets.

Tweet of The Week

$STRD is $STRF without all of the protections in place; non-cumulative, non-mandatory dividends, junior to $STRF.

$STRF = Investment Grade

$STRD = Junk GradeSaylor is coming for the entire fixed income market.

— Dylan LeClair (@DylanLeClair_)

8:44 PM • Jun 2, 2025

Podcast of The Week

📊 The Only Valuation Framework That Matters for Bitcoin Treasury Stocks

Forget P/E ratios - Bitcoin companies are balance sheet reactors, not traditional businesses. This new model breaks it down with BTC Yield, mNAV Months-to-Cover, and Premium Compression Velocity - and Wall Street has no clue. If you're serious about Bitcoin equities, this is your quant-grade edge.

If you have questions about how Bitcoin could help you or your business, please don’t hesitate to reach out for a free 30-minute consultation 🕒. We're here to help you navigate the future of Bitcoin 💡

Thanks for reading! We hope you’ve enjoyed this week’s edition and look forward to seeing you next week! 👋

Daniel

for Bitcoin on Balance

32 York Street, Sydney NSW 2000, Australia